from quantopian.pipeline import Pipeline

from quantopian.algorithm import attach_pipeline, pipeline_output

from quantopian.pipeline.data.builtin import USEquityPricing

from quantopian.pipeline.factors import SimpleMovingAverage

from quantopian.pipeline.classifiers.morningstar import Sector

from quantopian.pipeline.data import morningstar as morningstar

from quantopian.pipeline.filters.morningstar import Q500US, Q1500US

from quantopian.pipeline.factors.morningstar import MarketCap

from quantopian.pipeline.data import Fundamentals

import quantopian.algorithm as algo

def make_pipeline():

exchange = Fundamentals.exchange_id.latest

nyse_filter = exchange.eq('NAS')

#q500 = Q500US()

q1500 = Q1500US()

mktcap = MarketCap()

sector = morningstar.asset_classification.morningstar_sector_code.latest

mkt_cap = morningstar.valuation.market_cap.latest

pipe = Pipeline()

attach_pipeline(pipe, 'pipeline_tutorial')

pipe.add(Sector(), 'Sector')

pipe.add(mktcap, 'mktcap')

pipe.add(exchange, 'exchange')

pipe.set_screen(q1500 & nyse_filter)

return pipe

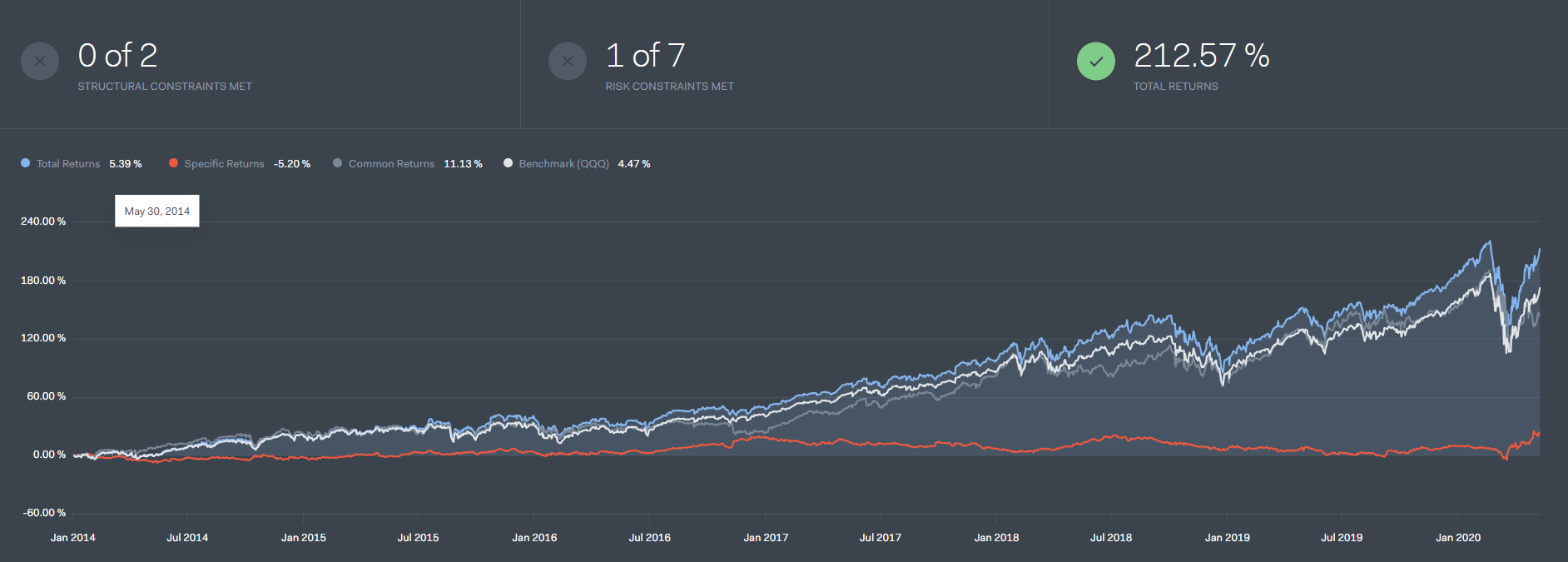

def initialize(context):

set_benchmark(symbol('QQQ'))

algo.schedule_function(

rebalance,

algo.date_rules.month_start(),

algo.time_rules.market_open(hours=1),

)

algo.attach_pipeline(make_pipeline(), 'pipeline')

context.buy_stock_count = 20

context.leverage = 1.0

#context.buy_stock_percent = float(context.leverage / context.buy_stock_count)

cash = context.portfolio.cash

context.purchase_value = cash / context.buy_stock_count

context.stocks_sold = []

def before_trading_start(context, data):

output = pipeline_output('pipeline_tutorial')

context.my_universe = output.sort('mktcap', ascending=False).iloc[0:context.buy_stock_count]

def rebalance(context, data):

"""

Execute orders according to our schedule_function() timing.

"""

if True:

for stock in context.my_universe.index:

buy_stock_percent = context.my_universe["mktcap"][stock] / context.my_universe["mktcap"].sum()

order_target_percent(stock, buy_stock_percent * context.leverage)

for stock in context.portfolio.positions:

if stock not in context.my_universe.index:

order_target_value(stock, 0)

pass5462